MUTUAL FUND

Smart way of growing wealth

SYSTEMATIC INVESTMENT PLAN

Starting small but early helps you build the habit of saving and investing.

A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future.

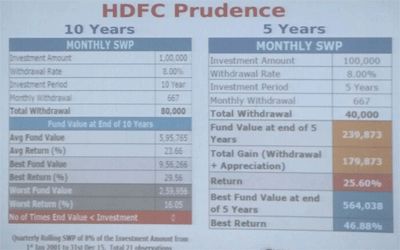

SYSTEMATIC WITHDRAWAL PLAN

Systematic Withdrawal Plan (SWP) is the facility by which an investor can withdraw a pre-determined amount from his existing investments in mutual funds at a pre-decided interval (weekly, monthly, quarterly, semi-annually or annually). Functionally, Systematic Withdrawal Plan (SWP) is similar to Systematic Investment Plan (SIP) but it gives an option to withdraw systematically. This helps in generating a regular cash flow for the investors. SWP in mutual fund is one of the most effective and tax efficient way to earn potential returns.

EQUITY LINKED SAVING SCHEME

These are tax-saving mutual funds that you can use to save income tax of up to Rs 1.5 lakh under Section 80C. ELSS funds have a lock-in period of 3 years and invest a majority of their portfolio in the stock market.

Investments can be made in lump sum, monthly(SIP), quarterly but the recommended way is through Systematic Investment Plans (SIP) that allow you to average your investment and save you from catching a market peak. Do remember that each SIP is considered to be a fresh investment and every individual SIP carries a lock-in period of 3 years.

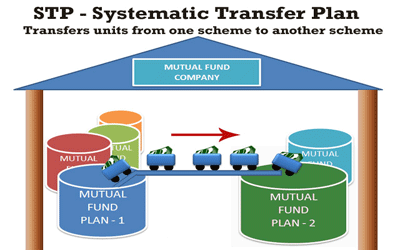

SYSTEMATIC TRANSFER PLAN

STP is a variant of SIP. STP is essentially transferring investment from one asset or asset type into another asset or asset type. The transfer happens gradually over a period.

Systematic Transfer Plan is of two types; fixed STP, and capital appreciation STP. A fixed STP is where investors take out a fixed sum from one investment to another. A capital appreciation STP is where investors take the profit part out of one investment and invest in the other.

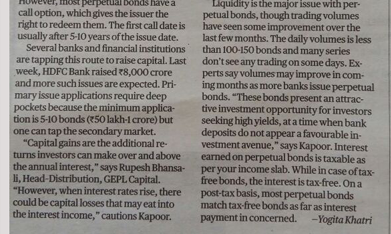

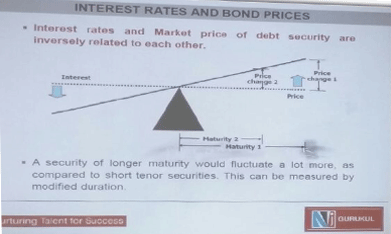

Bonds

Bonds are loans made to large organizations. These include corporations, cities and national governments. A bond is a piece of a massive loan. That's because the size of these entities requires them to borrow money from more than one source.

The borrowing organization promises to pay the bond back at an agreed-upon date. Until then, the borrower makes agreed-upon interest payments to the bondholder.

* Government Bonds

* Corporate Bonds

* banks and Other Financial Institutional Bonds

* Tax Seving Bonds

* Fix maturity Bonds.